ETH Price Prediction: Will Ethereum Reach $5,000?

#ETH

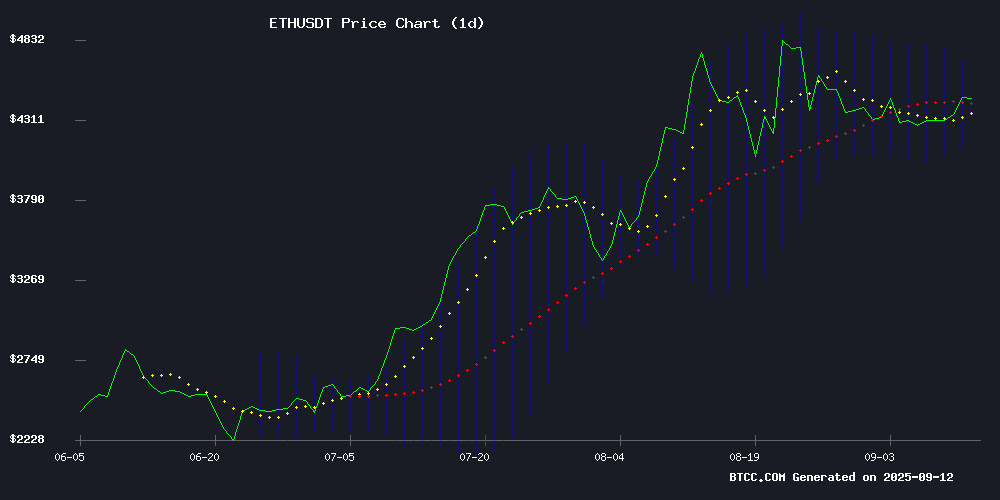

- ETH is trading above its 20-day moving average, indicating bullish technical momentum.

- Whale accumulation and institutional interest are driving positive market sentiment.

- Regulatory developments could impact short-term volatility but long-term outlook remains strong.

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

ETH is currently trading at $4,640.98, positioned above its 20-day moving average of $4,412.10, indicating sustained bullish momentum. The MACD reading of 14.53 suggests positive momentum with the fast line (120.22) above the slow line (105.69). Price action NEAR the upper Bollinger Band at $4,676.17 signals potential strength, though traders should monitor for overbought conditions. According to BTCC financial analyst Mia, 'The technical configuration supports further upside potential, with the $4,412 level now acting as crucial support.'

Market Sentiment: Institutional Demand and Regulatory Developments Fuel Optimism

Ethereum's reclaim of the $4,500 level, driven by significant whale accumulation, has bolstered expectations for a potential rally toward $7,000 by October. The ongoing legal confrontation between Coinbase and the SEC, particularly regarding missing communications from Chairman Gensler, adds a LAYER of regulatory uncertainty that markets are closely watching. BTCC financial analyst Mia notes, 'Institutional interest appears to be building at an unprecedented pace, suggesting this could be Ethereum's strongest cycle yet. Additionally, record network usage alongside declining fees demonstrates robust scalability improvements.'

Factors Influencing ETH's Price

Ethereum Reclaims $4,500 as Whale Buying Fuels $7K October Rally Outlook

Ethereum has surged back to $4,500, marking a 10% rebound from its September low, as institutional and whale activity signals growing confidence. Three whales acquired $205 million worth of ETH via FalconX, underscoring heavy accumulation at current levels. Corporate treasuries now hold over 6.5 million ETH—double April 2025 holdings—creating a supply squeeze.

Market sentiment hinges on the Federal Reserve's anticipated policy shift, with analysts eyeing a $7,000 October target if resistance breaks. On-chain metrics and exchange outflows suggest sustained demand, positioning ETH for its next leg up.

Coinbase Escalates Legal Battle with SEC Over Missing Gensler Texts

Coinbase has taken legal action against the U.S. Securities and Exchange Commission following the regulator's admission that it lost nearly a year of text messages from former Chair Gary Gensler. The crypto exchange filed a motion Thursday seeking court intervention to address what it calls the SEC's failure to properly preserve and produce communications relevant to ongoing disputes.

The filing cites an Inspector General report blaming 'avoidable' errors for the deletion of messages from Gensler and other top officials. Coinbase alleges the SEC conducted an incomplete search when responding to 2023-2024 FOIA requests, particularly regarding Ethereum's transition to proof-of-stake. The exchange is pushing for full disclosure, potential attorney fees, and consideration of a special counsel investigation.

An SEC spokesperson maintained the agency prioritizes transparency, noting current Chair Atkins immediately ordered corrective measures upon learning of the record-keeping lapse. The confrontation marks another chapter in Coinbase's increasingly adversarial relationship with financial regulators as the crypto industry demands clearer compliance standards.

Ethereum's Institutional Surge Signals Strongest Cycle Yet

Ethereum breached $4,600 amid accelerating institutional adoption, with treasury allocations and ETF inflows mirroring Bitcoin's post-ETF trajectory. CryptoQuant data reveals a whale staking $645 million in ETH, while 73% of Myriad traders now bet on $5,000 targets—up 12 percentage points this week.

"This isn't retail FOMO—it's strategic capital positioning," said CryptoQuant's Julio Moreno. The network's staking boom and institutional endorsement create a self-reinforcing cycle: locked supply tightens liquidity just as corporate treasuries and ETFs demand exposure. Unlike past cycles where whales cashed out, current holders appear focused on long-term infrastructure bets.

Ethereum's Scaling Paradox: Record Usage Amid Plummeting Fees

Ethereum's blockchain activity reveals a striking contradiction. Transaction volumes and unique addresses have surged to all-time highs, yet network fees languish near cycle lows. The median transaction cost has collapsed even as rollups process record volumes of bundled transactions—particularly stablecoin trades—without congesting the base layer.

This divergence underscores Ethereum's evolution into a settlement layer. Value now accrues through L2 ecosystems and applications rather than exorbitant L1 fees. Net issuance remains positive but subdued, with fee revenue dramatically below 2021-22 peaks. The network's worth increasingly derives from its neutral infrastructure role rather than rent extraction.

Technical improvements tell part of the story. Gas target adjustments, cleaner mempool dynamics, and MEV mitigation have enhanced efficiency. But the larger narrative centers on Ethereum's growing gravitational pull—its ability to attract developers and users through security and decentralization while offloading scale to secondary layers.

Will ETH Price Hit 5000?

Based on current technical indicators and market sentiment, ETH has a strong probability of testing the $5,000 level. The price is trading well above the 20-day MA, and bullish MACD momentum supports further gains. Whale accumulation and growing institutional interest, as highlighted in recent news, provide fundamental backing for upward movement. However, regulatory developments, such as the Coinbase-SEC case, could introduce volatility.

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $4,640.98 | Bullish above 20-day MA |

| 20-Day MA | $4,412.10 | Key support level |

| MACD | 14.53 | Positive momentum |

| Bollinger Upper Band | $4,676.17 | Near-term resistance |